Exclusive: At Least Three Top-Tier VCs in Silicon Valley Have Reached Out to Manus AI

With sky-high pricing and top-tier VC interest, Manus sets its sights on the U.S.

After the initial buzz and controversy around being “hot in China but cold overseas” faded, Monica AI’s general-purpose AI agent, Manus AI, now appears to be making a serious push into the U.S. market.

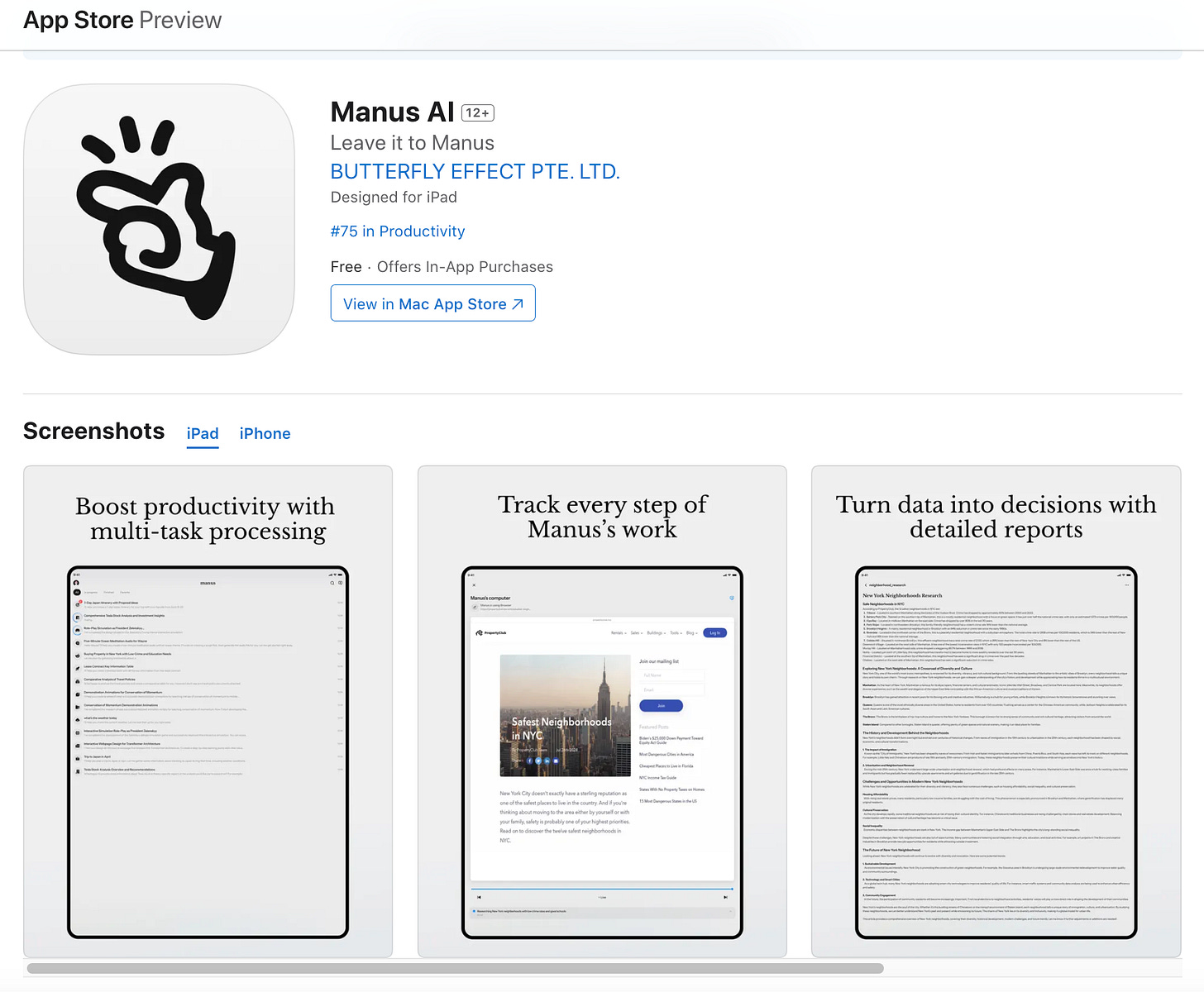

On March 28, the Manus AI mobile app officially launched on the U.S. Apple App Store, along with its pricing tiers: $55/month for the Starter plan, and a staggering $279/month for the Pro version. For comparison, OpenAI’s ChatGPT Pro—which offers unlimited access to its flagship o1 model and advanced tools—costs $200/month and is already considered one of the priciest foundation model subscriptions available.

That makes Manus Pro the most expensive generative AI tool currently on the market. The hefty price tag may reflect its massive token usage and backend compute requirements. According to the company, each completed task can cost as much as $2 in inference costs, consuming hundreds of thousands to millions of tokens. And because user requests are often complex, follow-up subtasks are frequently triggered mid-process, pushing compute and token consumption even higher.

NVIDIA founder and CEO Jensen Huang noted during his GTC 2025 keynote that the inference workloads powering many AI agents require over 100 times the compute of traditional large language model queries. While Manus doesn’t train its own models, it uses Anthropic’s Claude 3.5, one of the most expensive APIs in the market. Running this kind of system also demands powerful, high-performance infrastructure—adding significantly to operational costs.

In this context, a $279/month price point may be justifiable. While the pricing has sparked mixed reactions online, some Manus users told GenAI Assembling that they find the product’s task performance and interaction design superior to other general-purpose agents—particularly those built directly on OpenAI’s Operator platform. While it may not be the most polished agent overall, Manus is certainly among the most capable. That said, the question remains: should a tool built on top of foundation models cost more than the models themselves?

Now that the product has moved beyond invite-only access and into paid subscriptions, Manus is expected to respond to real-time user requests, including high-concurrency moments. This shift raises the bar for both infrastructure scalability and customer support, and ultimately, points to one thing: Manus needs more capital.

According to The Information, Butterfly Effect, the parent company of Manus AI, is currently raising a new funding round in Silicon Valley at a reported $500 million valuation. The company has previously raised funding from ZhenFund, Tencent, and Sequoia China. Sources close to the matter told GenAI Assembling that at least two core members of the Manus team recently met with several top VCs in the Bay Area, and that three major firms have already expressed strong interest. That said, the Manus team may not accept all offers.

While Manus didn’t exactly “shake up Silicon Valley” at launch—contrary to claims by some AI influencers—it has quietly gained real traction in the local AI community. Founders, developers, and investors—particularly Chinese professionals embedded in the Valley—have helped Manus grow by distributing invite codes and spreading the word. In late March, Manus hosted its first user meetup in San Francisco, further signaling its intent to localize.

GenAI Assembling has also learned that Manus is now considering building a U.S.-based team, potentially following a path similar to that of HeyGen. Founded in Shenzhen by former Snap engineer Joshua Xu, HeyGen went viral with its AI-generated videos of Taylor Swift speaking Mandarin and Guo Degang doing stand-up in English. In June 2024, HeyGen closed a $60 million round led by Benchmark, with participation from Conviction, Thrive Capital, and Bond Capital, and subsequently relocated its team to Los Angeles.

If Manus follows suit, it may be preparing for a full-fledged international expansion—starting with users, followed by operations and talent. Even if the shift isn’t total, it marks a clear strategic pivot from a viral Chinese AI product to a serious contender in Silicon Valley’s rapidly evolving agent ecosystem.