NVIDIA’s stellar earnings fail to impress Wall Street as AI’s future remains uncertain

When historic growth meets harsh reality...

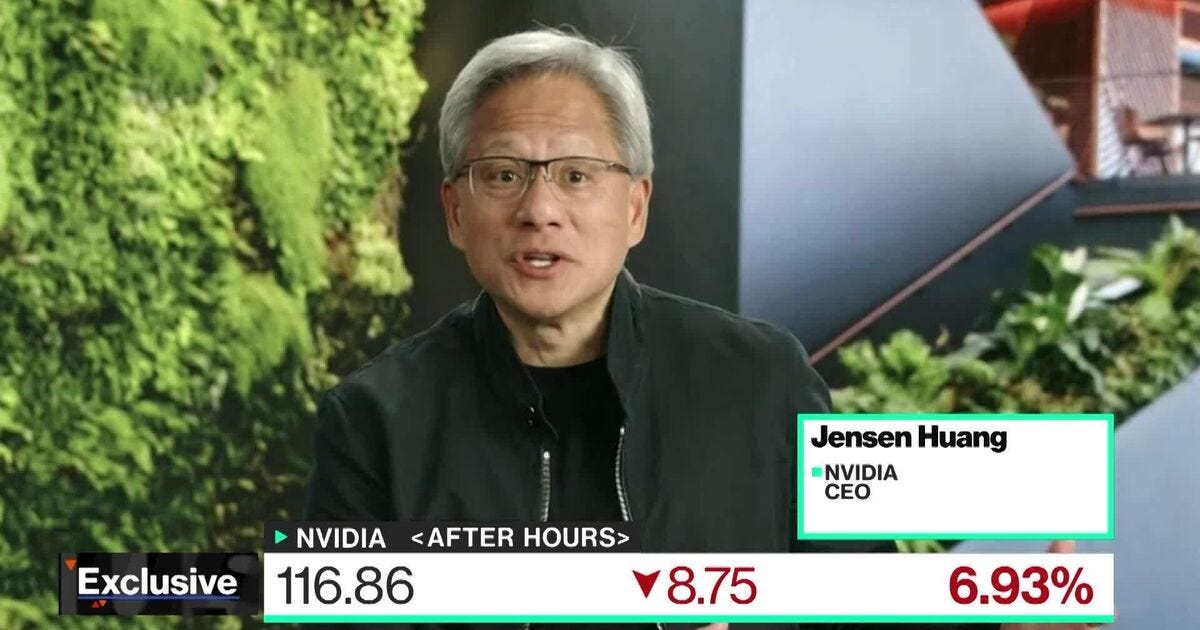

This week, the global market eagerly awaited NVIDIA’s Q2 FY2025 earnings report. Once again, CEO Jensen Huang delivered outstanding results, quelling fears of a downturn—at least for now. However, despite record-breaking numbers, NVIDIA’s stock plummeted over 8% following the earnings call, dragging the entire tech sector down with it. So, what went wrong?

Record performance beats Wall Street’s expectations

NVIDIA reported $30.04 billion in revenue, up 122% year-over-year, and net profits of $16.6 billion, with adjusted earnings per share of $0.68. These figures surpassed expectations, driven by strong demand for its Hopper GPU computing and networking platform. Data center revenue hit $26.3 billion, up 154%, while gaming revenue increased by 16% to $2.9 billion.

Despite these impressive results, Wall Street was left unimpressed. NVIDIA’s stock has been on a rollercoaster—surging 1202% over two years—yet recent setbacks, including insider selling and delays in the next-generation Blackwell chips, have led to market volatility. Given this backdrop, NVIDIA’s latest earnings report was seen as a critical barometer for the AI market’s health.

Key earnings call highlights

During the earnings call, NVIDIA addressed the delay in Blackwell GPU production, with CFO Colette Kress confirming that design issues had been resolved. Mass production is expected to begin in Q4, but demand continues to outstrip supply. NVIDIA also unveiled more details about Blackwell at the Hot Chips 2024 conference, highlighting its potential to enhance AI computing performance significantly.

Jensen Huang emphasized that accelerated computing, particularly with Hopper and Blackwell GPUs, remains the most prudent investment in AI infrastructure. He added that H100 orders are increasing significantly, as everyone is working to upgrade their existing infrastructure to the most advanced level.

Despite concerns from other tech giants about the ROI of AI investments, Huang confidently stated that NVIDIA’s technology offers rapid returns, thanks to the growing demand for generative AI.

Challenges in the Chinese market and AI sovereignty

NVIDIA began selling modified AI chips H20 to Chinese customers this year, boosting Q2 data center revenue from China by 33.8% to $3.7 billion. However, this still falls short of pre-export control levels. Huang also discussed the growing importance of AI sovereignty, noting that countries are increasingly seeking to develop their own AI technologies to ensure data security. NVIDIA aims to capitalize on this trend by providing advanced AI platforms tailored to national needs.

Wall Street’s disappointment and uncertainty in AI’s future

Despite providing an optimistic Q3 revenue forecast of $32.5 billion and approving a $50 billion stock buyback plan, NVIDIA’s stock dropped. Analysts pointed out that NVIDIA’s guidance for Q3, projecting 75.8% to 82.9% growth, fell short of Wall Street’s most optimistic expectations. After six quarters of triple-digit growth, this slowdown in revenue growth left investors disappointed.

Wall Street, once viewing NVIDIA as a crystal ball for AI’s future, is now questioning whether the AI boom will continue as expected. The stock drop reflects a growing uncertainty—even Jensen Huang, it seems, cannot predict the next phase of this AI revolution.